Maryland Car Insurance

The average cost of Maryland car insurance is $103/mo, or $1,240/yr, which is 13.1 percent lower than the national average. Car insurance in Maryland operates under no-fault insurance laws, and drivers are required to obtain both liability and personal injury protection insurance for any car registered in the state. Enter your ZIP code below to get free Maryland auto insurance quotes.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Minimum car insurance requirements and regulation is done by The Maryland Insurance Administration

- When it comes to car insurance, Maryland is a no-fault state

- Maryland requires specific insurance coverage, including liability and PIP

Car insurance in Maryland operates under a set of no-fault car insurance laws and drivers are required to obtain both liability and personal injury protection insurance for any car registered in the state.

Minimum car insurance requirements are regulated by The Maryland Insurance Administration.

However, any law enforcement official and/or the Department of Motor Vehicles can issue citations, suspend your drivers’ license and/or vehicle registration tags if you fail to comply with these laws.

While car insurance laws in Maryland require all drivers to have minimum levels of liability auto insurance these requirements are still extremely low in terms of how much potential liability exposure you could have in the event of an accident.

Ready to compare car insurance quotes? Enter your zip code above to get started for FREE!

Maryland Car Insurance Requirements

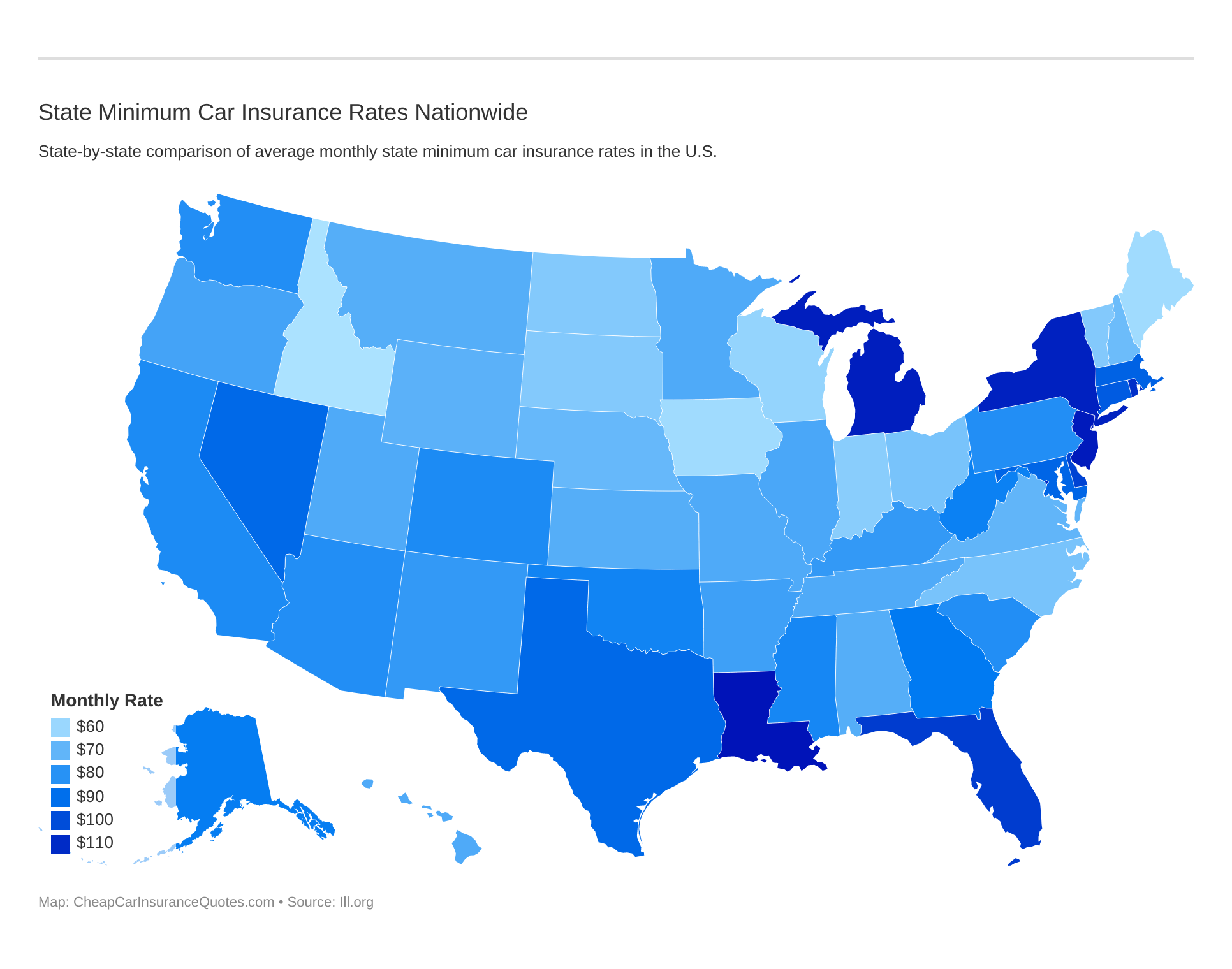

Take a look at how state minimum car insurance rates vary from state to state.

Maryland has no-fault car insurance laws, which means there is no determination of guilt or “who was at fault” in a car accident.

This helps protect drivers from car accident lawyers who like to sue for every sore neck and also expedite handling of your car insurance claim as your car insurance company is obligated to pay your damages and vice-versa for the other driver.

No-fault car insurance laws are not a replacement for waiving all liability, however.

In Maryland (or any other state) you can still get sued no matter what car insurance laws are in place if the damages exceed the amount of your policy coverage.

Take a look at Maryland’s minimum car insurance requirements:

- $20,000 liability coverage per person per accident

- $40,000 liability insurance for all persons per accident

- $15,000 property damage

- Personal Injury Protection

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Do you think if you hit a vehicle and a passenger has to undergo medical surgery $20,000 will cover the cost?

Probably not, especially given the cost of health care and emergency room expenses today and anything over $20,000 you are on the hook for.

Most Maryland drivers opt for much higher limits of coverage (exceeding $100,000 for many) and only incur a small premium increase.

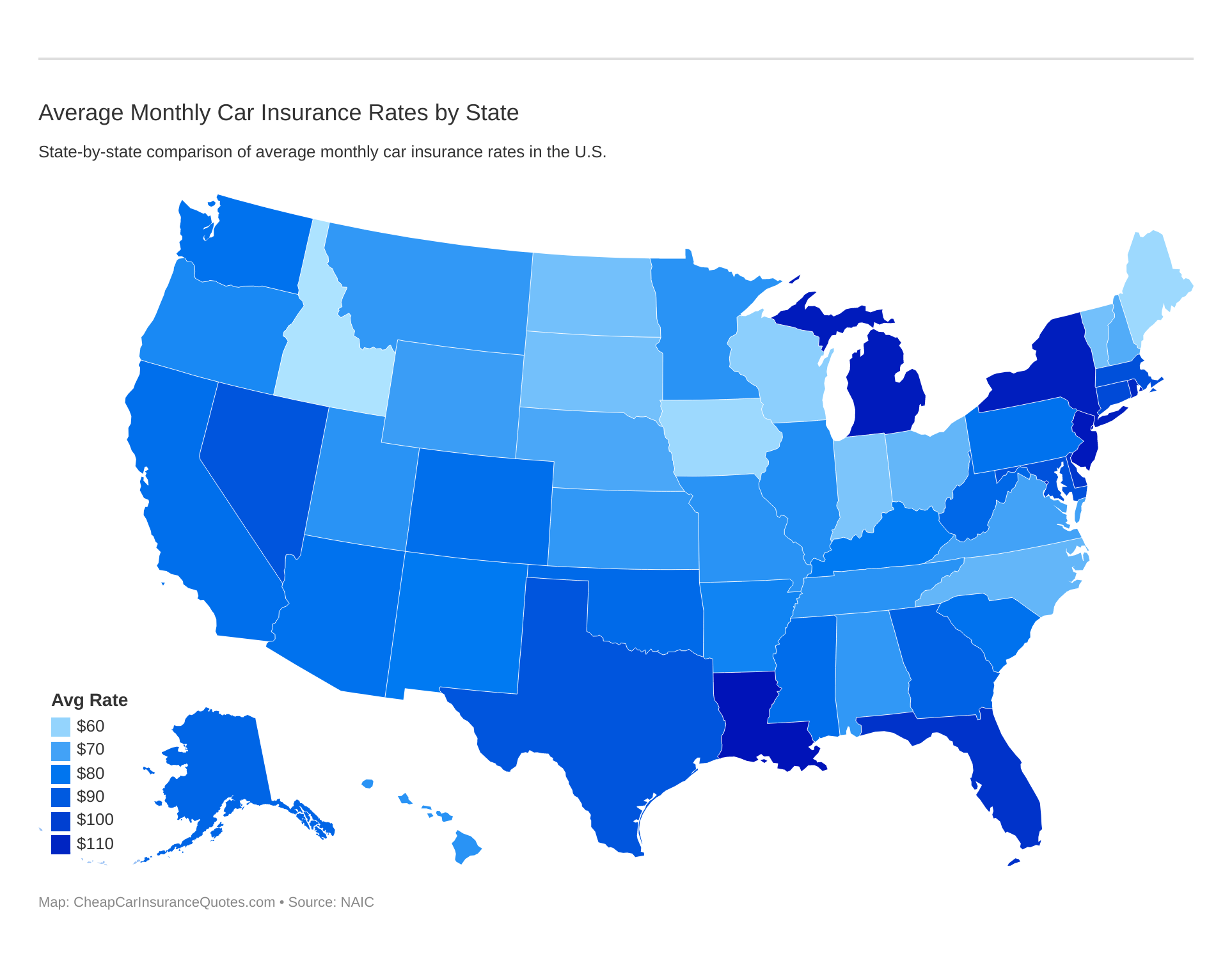

Let’s take a look at the average monthly car insurance rates.

There are also exceptions to litigation in no-fault car insurance states if the accident was due to extreme negligence (such as excessive speeding or a purely intentional act) where you can and most likely will be sued.

Before choosing any car insurance policy you really need to understand all the types of auto insurance :

- Comprehensive

- Collision

- Liability

- GAP

Maryland Car Insurance Quotes

Maryland has almost 120 licensed car insurance companies in the state so finding an auto insurance provider will be very easy.

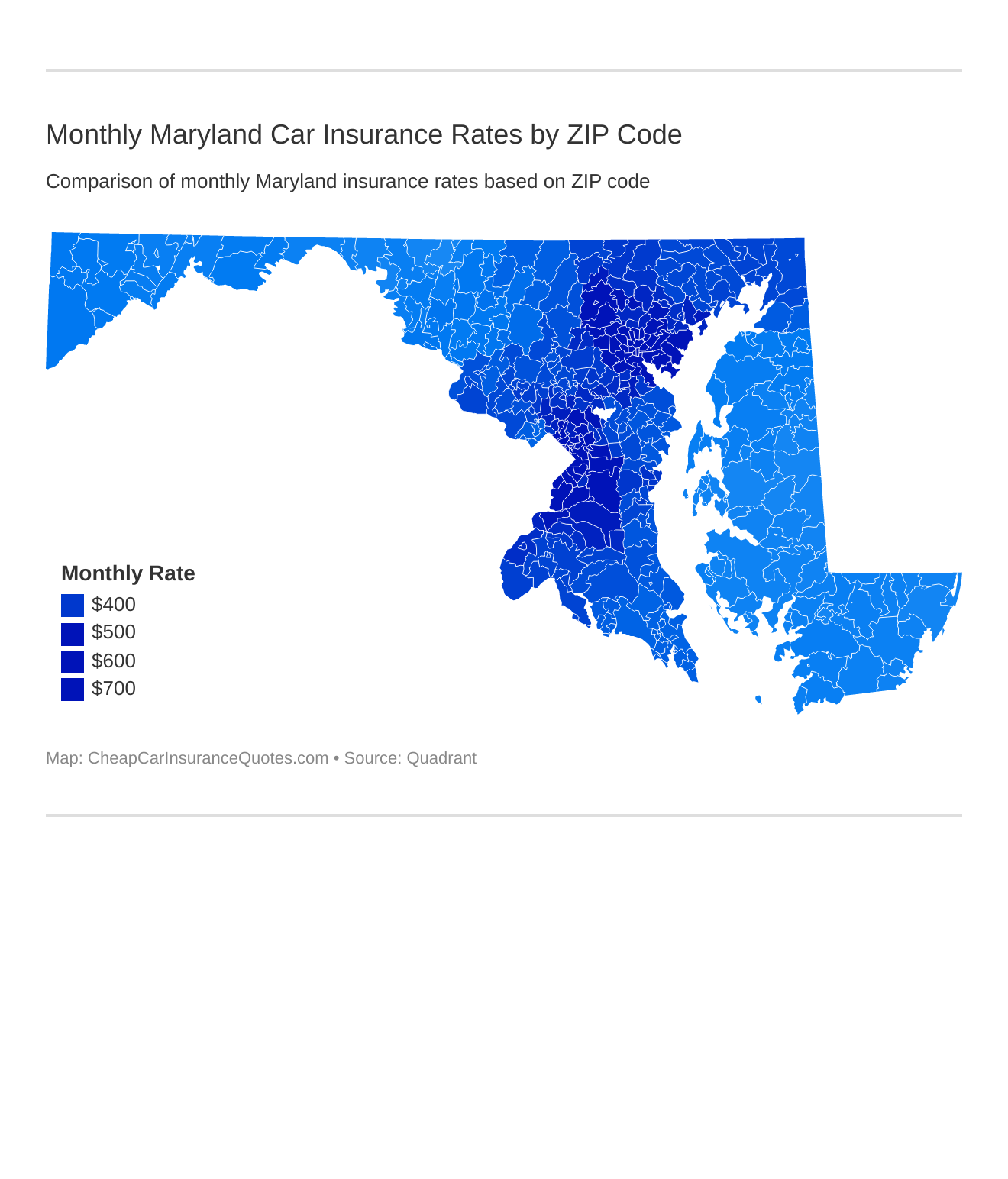

Let’s take a closer look at how ZIP codes affect car insurance in Maryland.

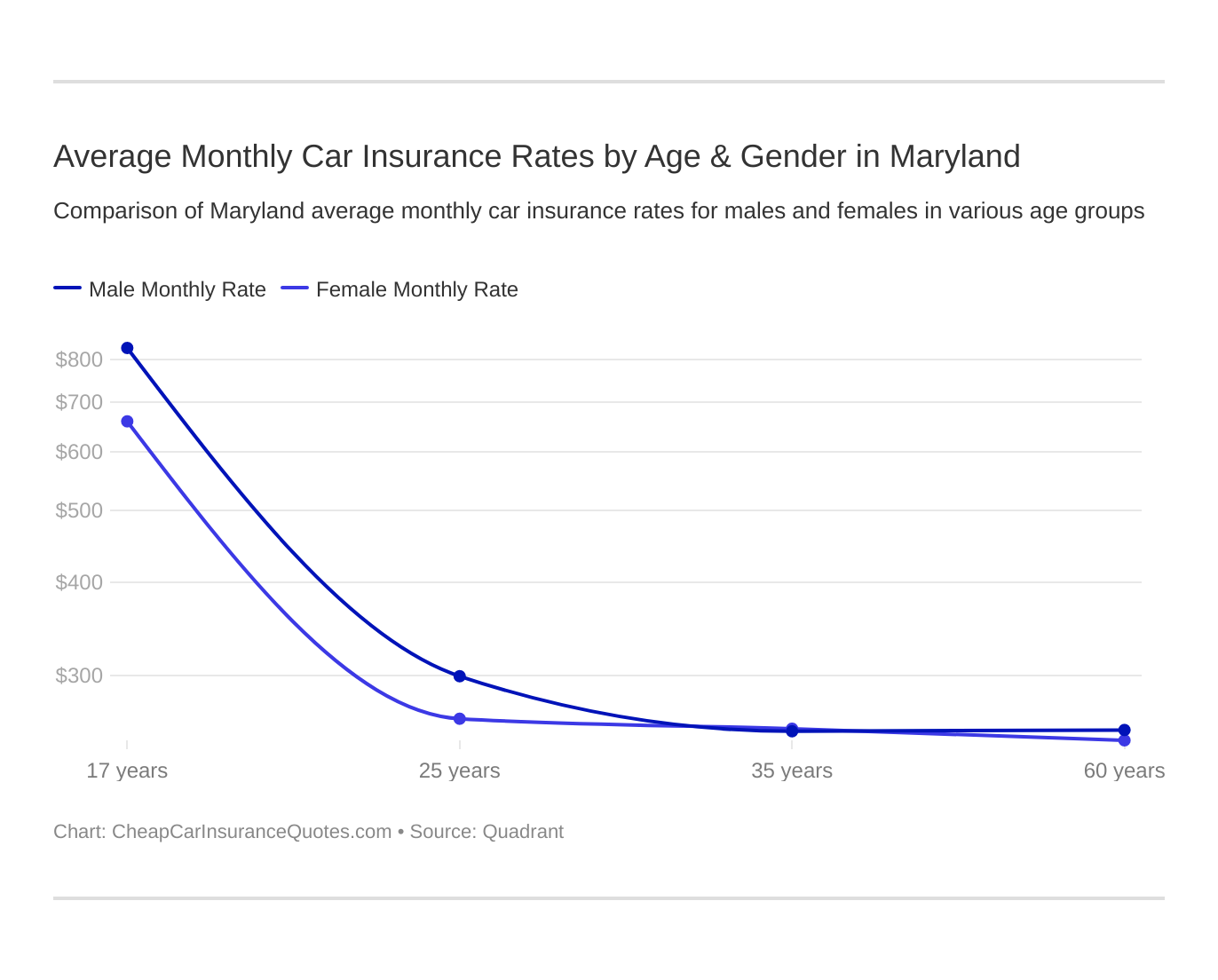

Age and gender will affect your car insurance. Younger drivers are often in a high risk class. See if the gender stereotype (males pay more) holds true in MD.

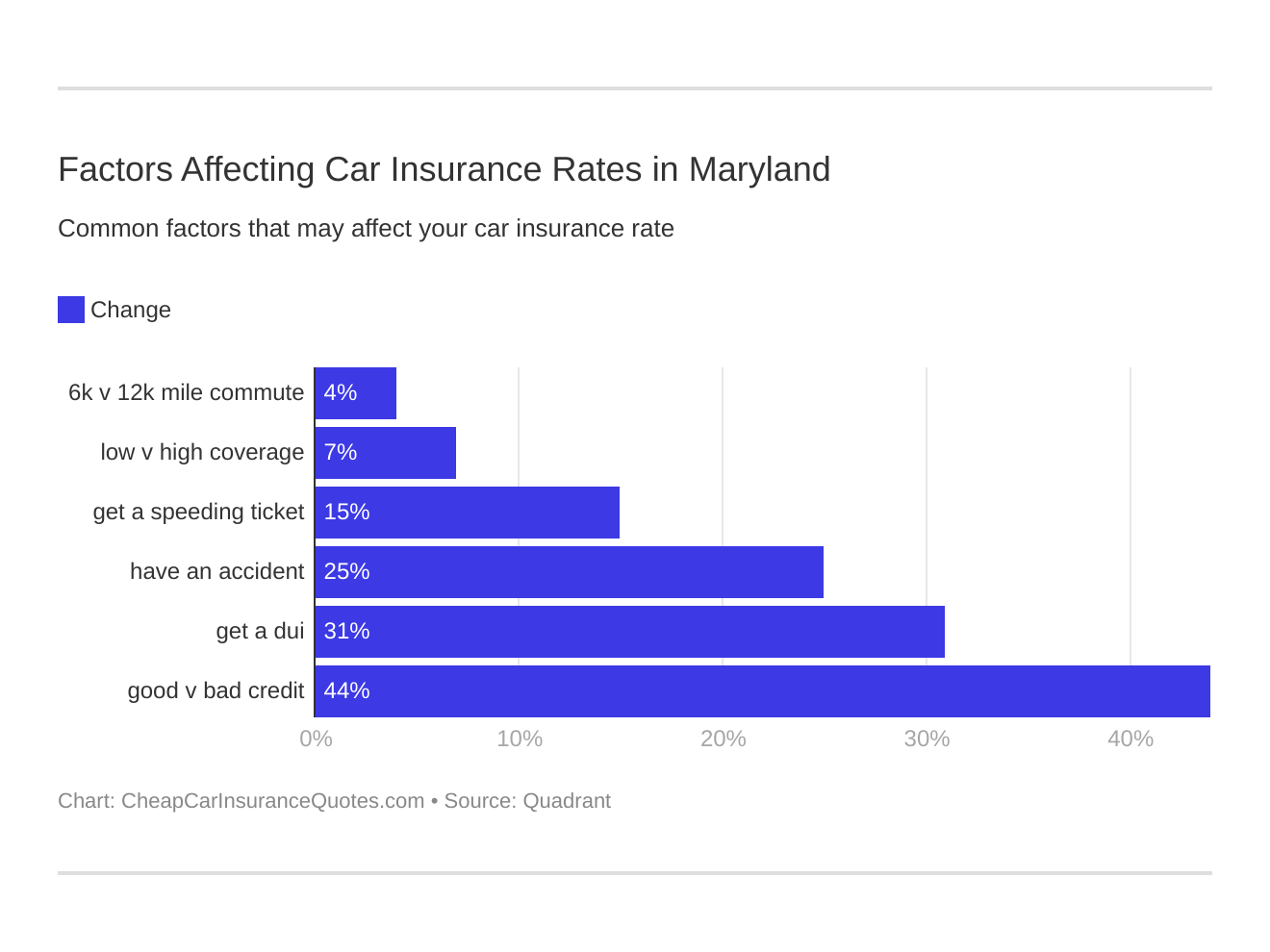

Take a look at these 6 major factors affecting auto insurance rates in Maryland.

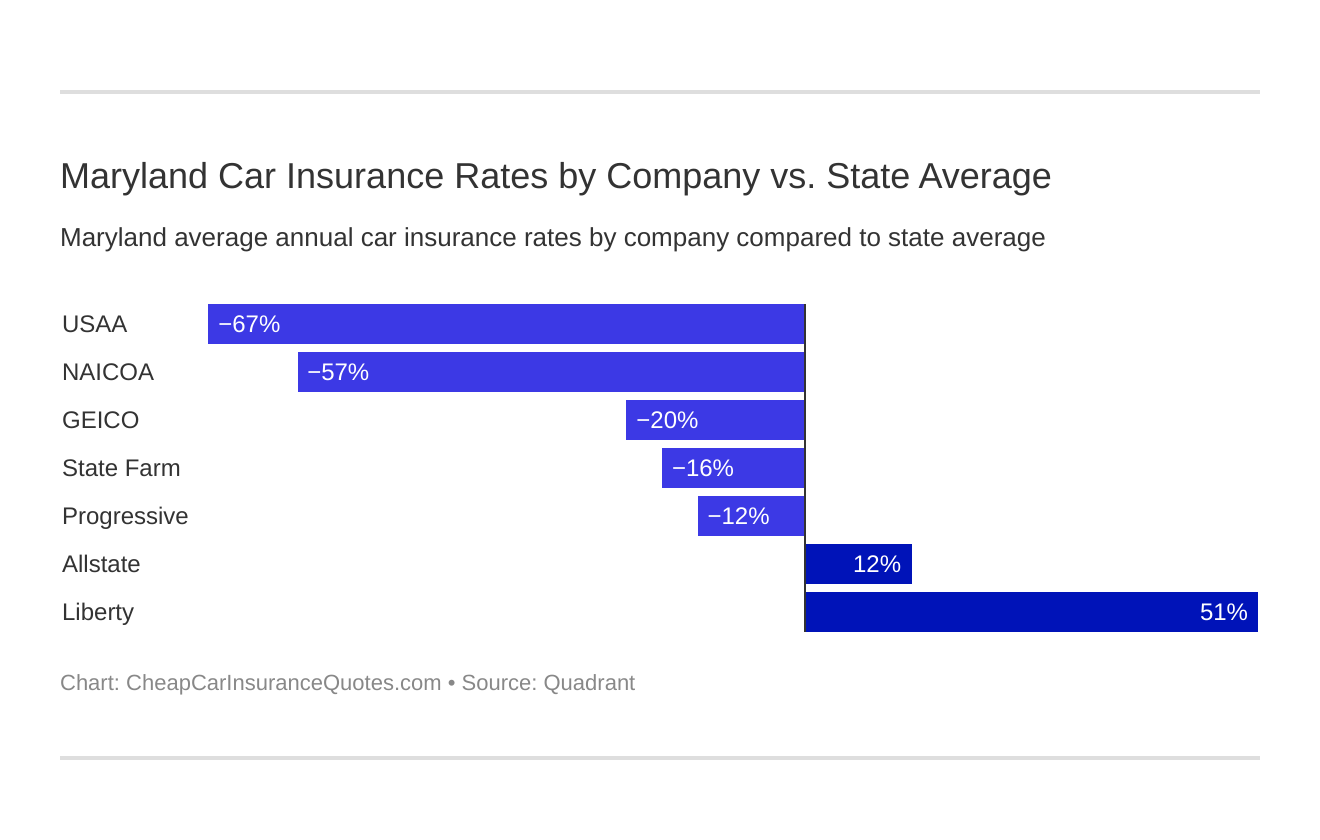

Now let’s see who is the cheapest car insurance company in Maryland.

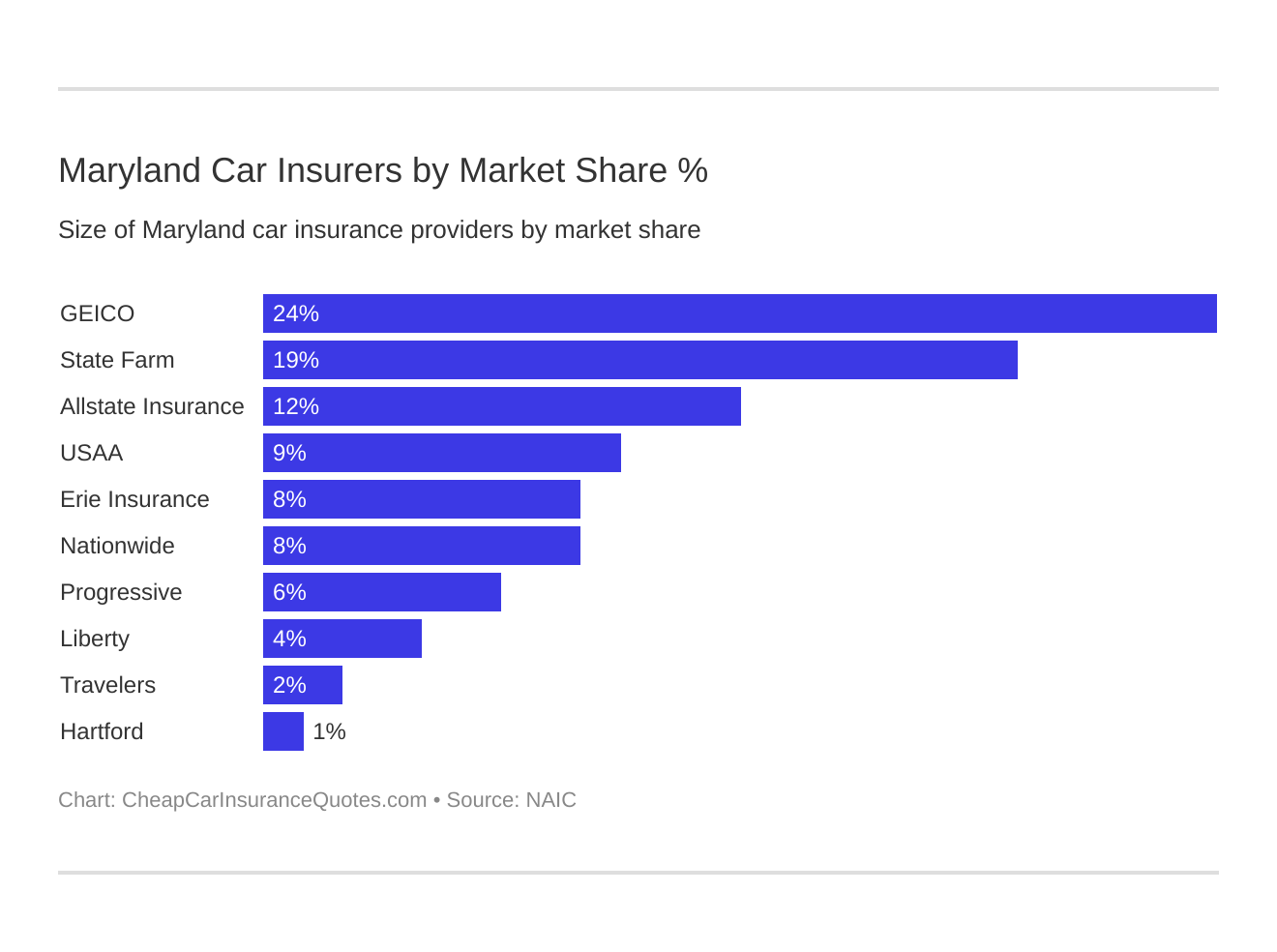

Who are the largest car insurance companies in Maryland?

Discover Car Insurance Cost in Maryland by City

Curious about how car insurance expenses differ between Aberdeen and New Windsor in Maryland? Dive into our comparison to uncover insights and find the best rates for your needs. Ready to explore? Let’s compare rates now.

| Car Insurance Cost in Maryland by City |

|---|

| Aberdeen, MD |

| New Windsor, MD |

Take your time and compare car insurance policies equally without focusing on premiums until the end.

Finding a good car insurer is critical to your liability and the safety of others but there is no obligation to choose any particular company.

Car insurance may be mandatory but the choice to find the best car insurance company is all yours. Enter your zip code below and start comparing quotes for FREE!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.