Illinois Car Insurance

Illinois car insurance costs $93/mo, or $1,120/yr, which is 21.6 percent less than the national average. Illinois auto insurance laws are set by the state Department of Insurance and require all drivers to have liability coverage in place before registering or operating a vehicle. All drivers must keep proof of insurance in the vehicle to show law enforcement upon request. Get coverage now with our free quote comparison tool below.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Car insurance is mandatory for all vehicles registered in the state of Illinois

- Car insurance laws in Illinois are set by the Illinois Department of Insurance

- Unlike other states, Illinois also has an automated enforcement system which randomly selects drivers asking them to send in proof of insurance

Car insurance is mandatory for all vehicles registered in the state of Illinois.

Any driver convicted of driving with no car insurance can face heavy fines, drivers license suspension, vehicle registration suspension, personal liability and more.

Enter your zip code above to get FREE car insurance quotes today!

Illinois Car Insurance Requirements

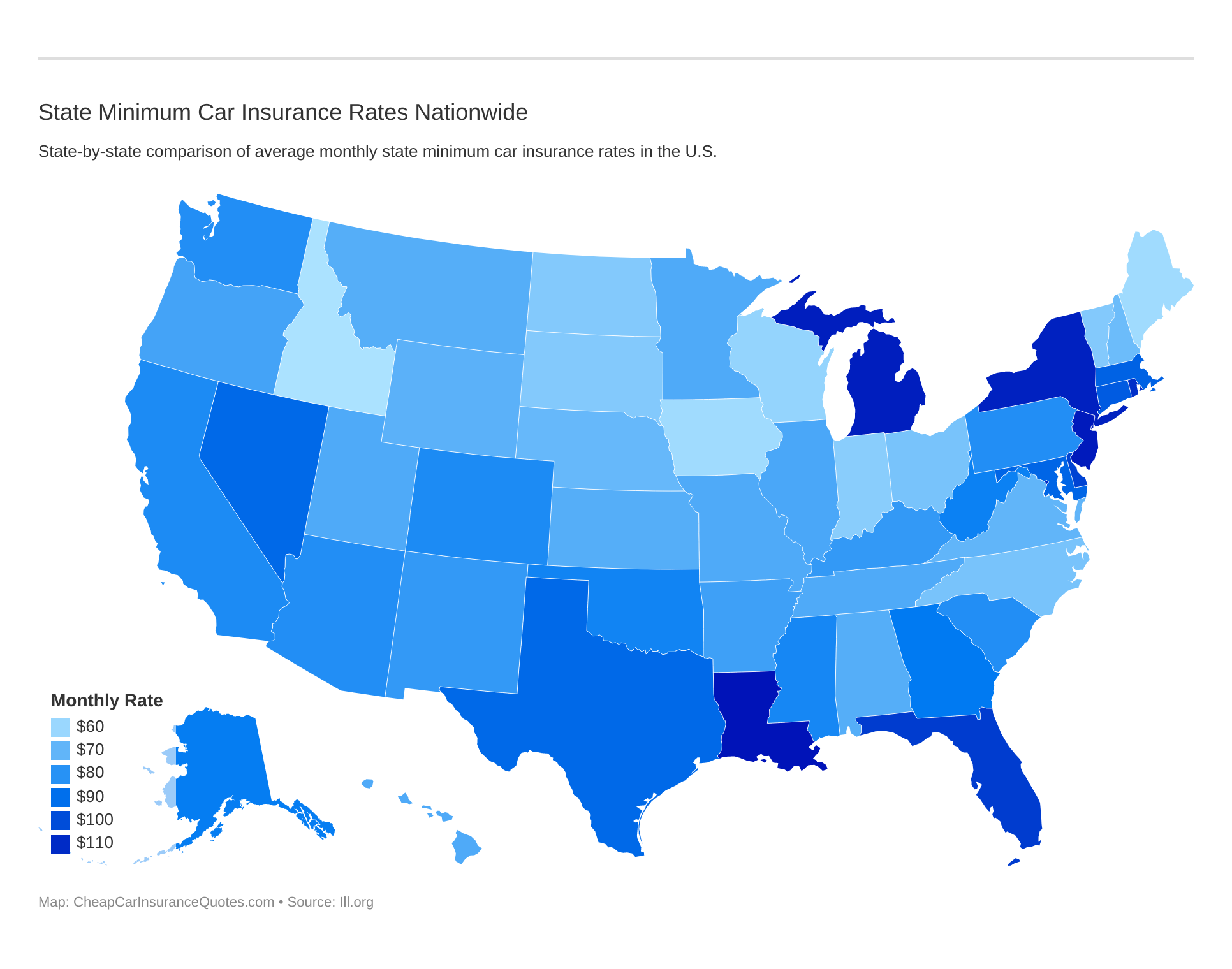

Minimum auto insurance coverage and rates vary from state to state. Compare state to state below:

Car insurance laws in Illinois are set by the Illinois Department of Insurance and currently state that all drivers must have liability coverage in place before registering or operating a vehicle.

The minimum levels of liability insurance required in Illinois are:

- $20,000 – liability insurance per person in a car accident

- $40,000 – total liability insurance for all persons in a car accident

- $15,000 – property damage coverage

The State of Illinois also requires all drivers to keep proof of a valid auto insurance policy in the vehicle to show law enforcement upon request.

Unlike other states, Illinois also has an automated enforcement system which randomly selects drivers asking them to send in proof of insurance to the state.

Failure to respond can result in suspension of your motor vehicle registration tags.

If convicted, the minimum fine is $500.

If you are convicted of driving with no auto insurance in the state of Illinois, but this fine is minimal to the amount of personal liability you expose yourself to when operating a vehicle with no auto insurance.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Illinois Auto Insurance Companies

Car insurance companies are easy to find in Illinois with almost 200 licensed car insurers. In fact, Illinois is the State with the highest number of licensed auto insurance companies followed by Indiana and Georgia.

Keep in mind that Illinois operates under tort law where you can be sued for even minor accidents.

There is no form of protection from minor car accidents as in states with no-fault auto insurance laws.

While Illinois minimum auto insurance requirements seem reasonable enough, they are actually far less than any responsible driver should have.

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive. Review rates for car insurance coverage below:

While liability insurance does offer some form of protection for any car accident where injuries occur can easily surpass your limits of coverage and expose you to personal liability for damages above your policy limits.

Most Illinois drivers opt for comprehensive, collision and uninsured/underinsured motorist coverage on top of state minimum liability requirements as well as expanded levels of coverage exceeding $100,000.

Illinois Car Insurance Rates

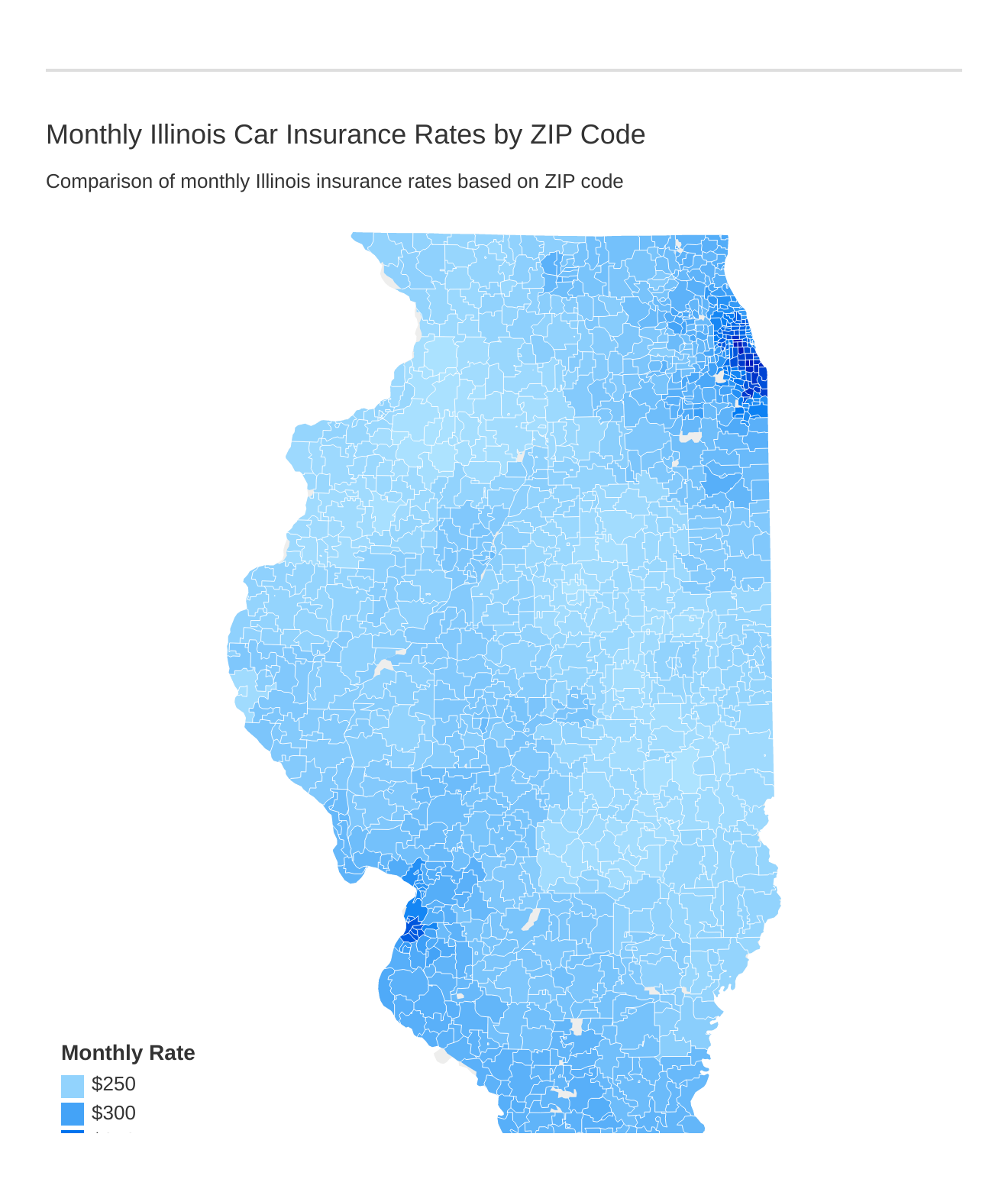

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in IL.

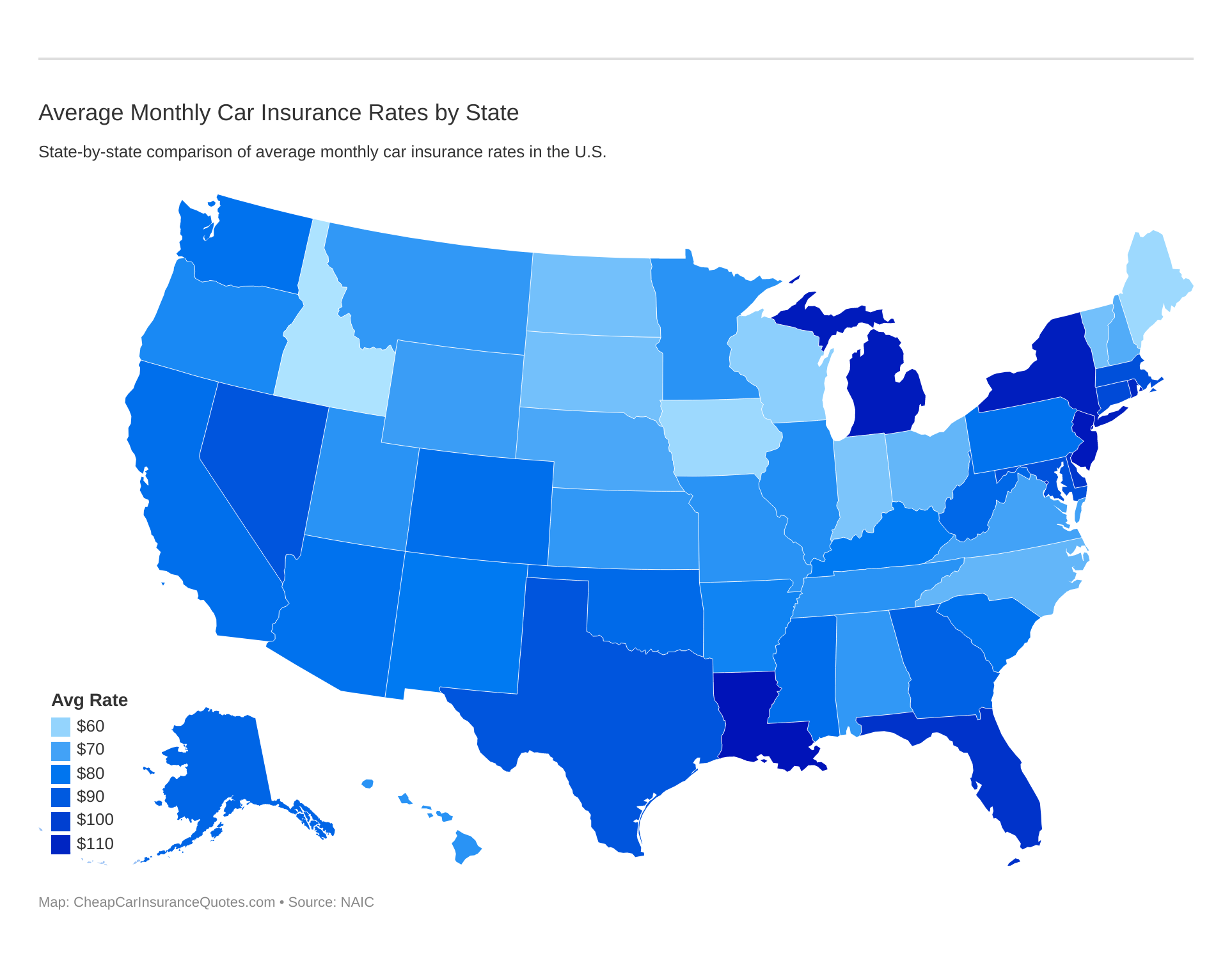

With comparison to other states, Illinois is a top 10 state for auto insurance premiums where drivers usually pay around 20 percent higher than the national average.

For a 40-year-old male using common variables, the average Illinois car insurance premium is $1,680 compared to a national average of $1,430.

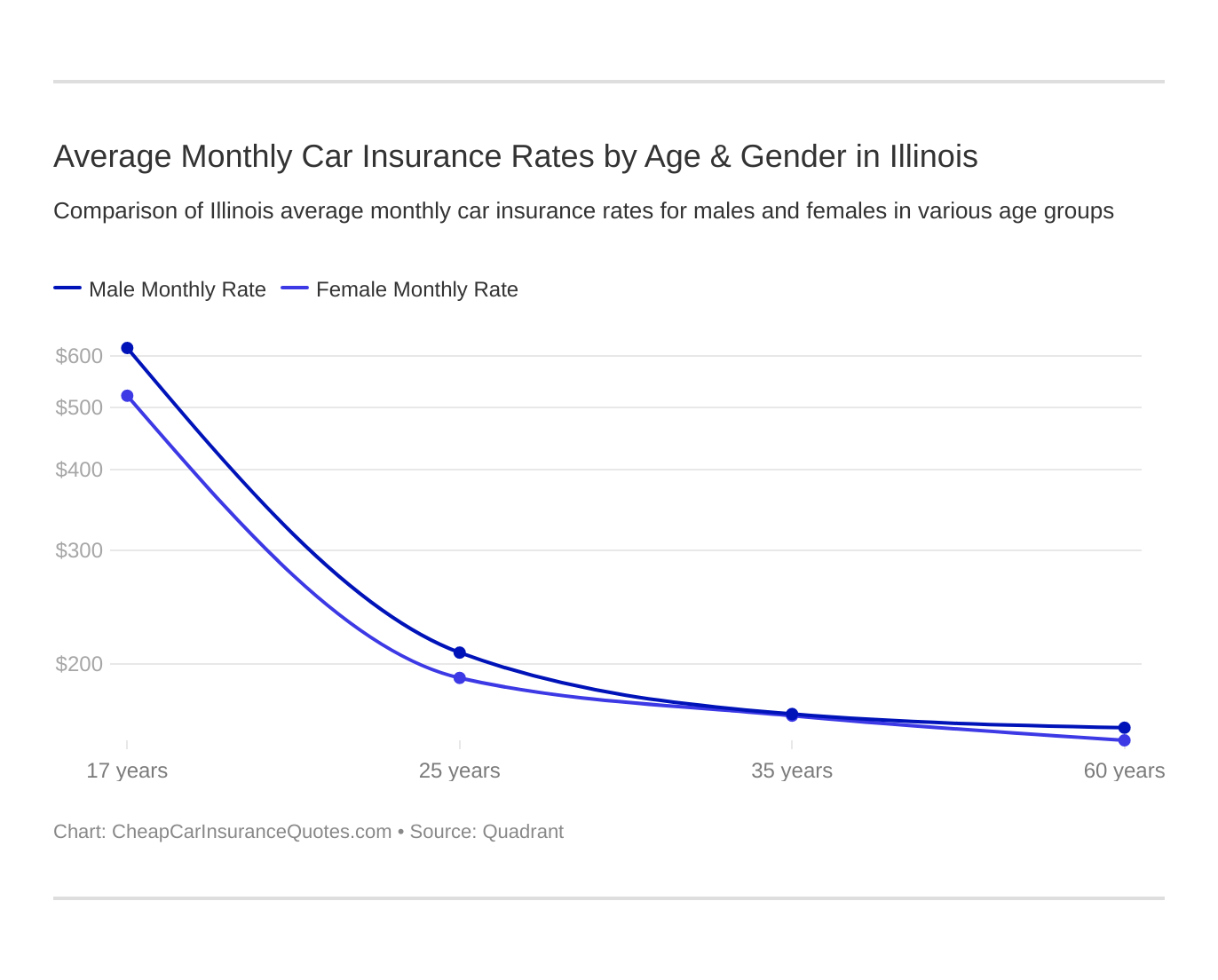

Which gender and age pays more for car insurance? Drivers under 25 years old are often in the highest risk class. See if the gender stereotype (males vs female auto insurance rates) holds true in Illinois.

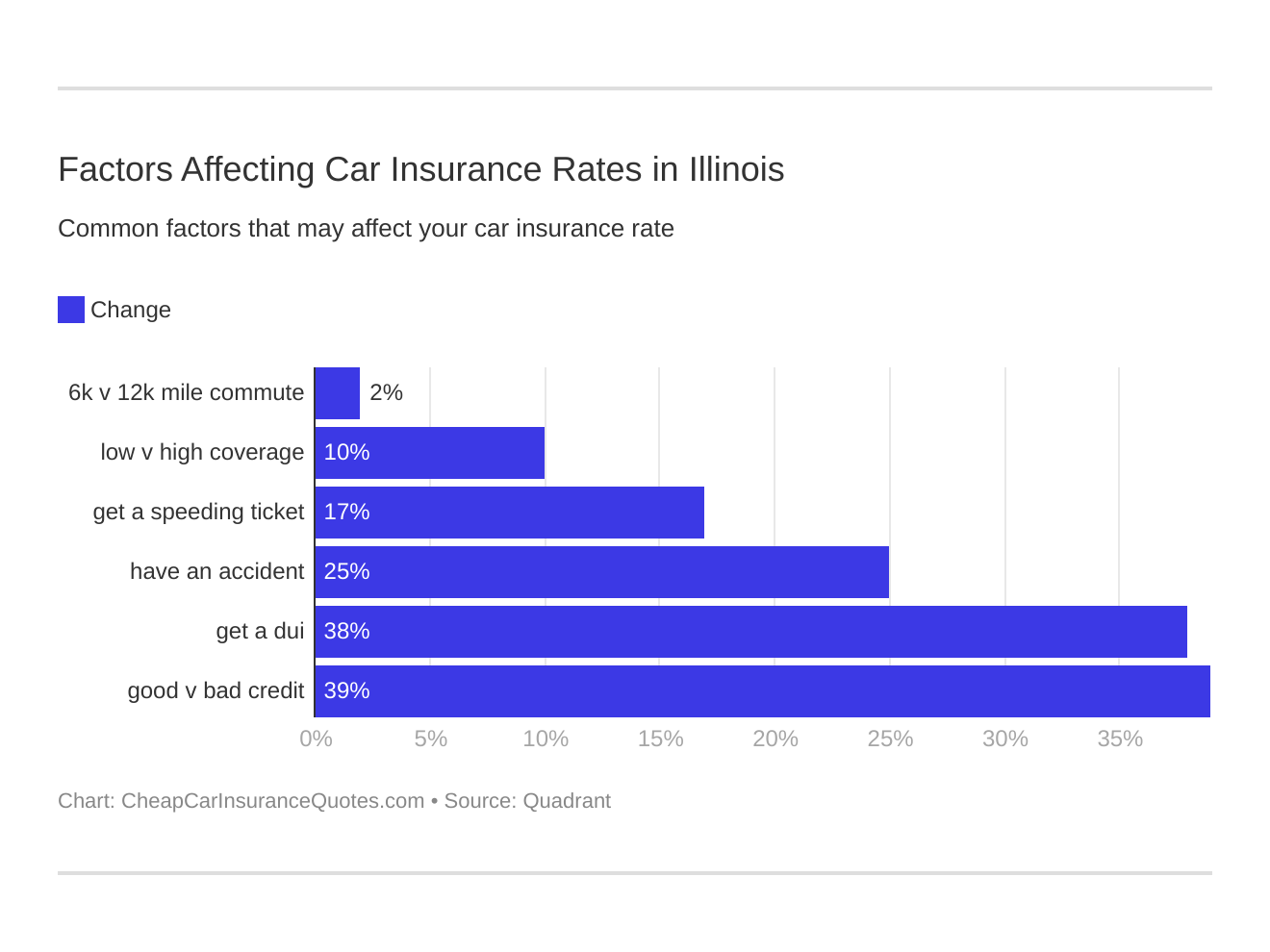

Six major factors affect auto insurance rates in IL. Which car insurance factors will affect your rates the most? Find out below:

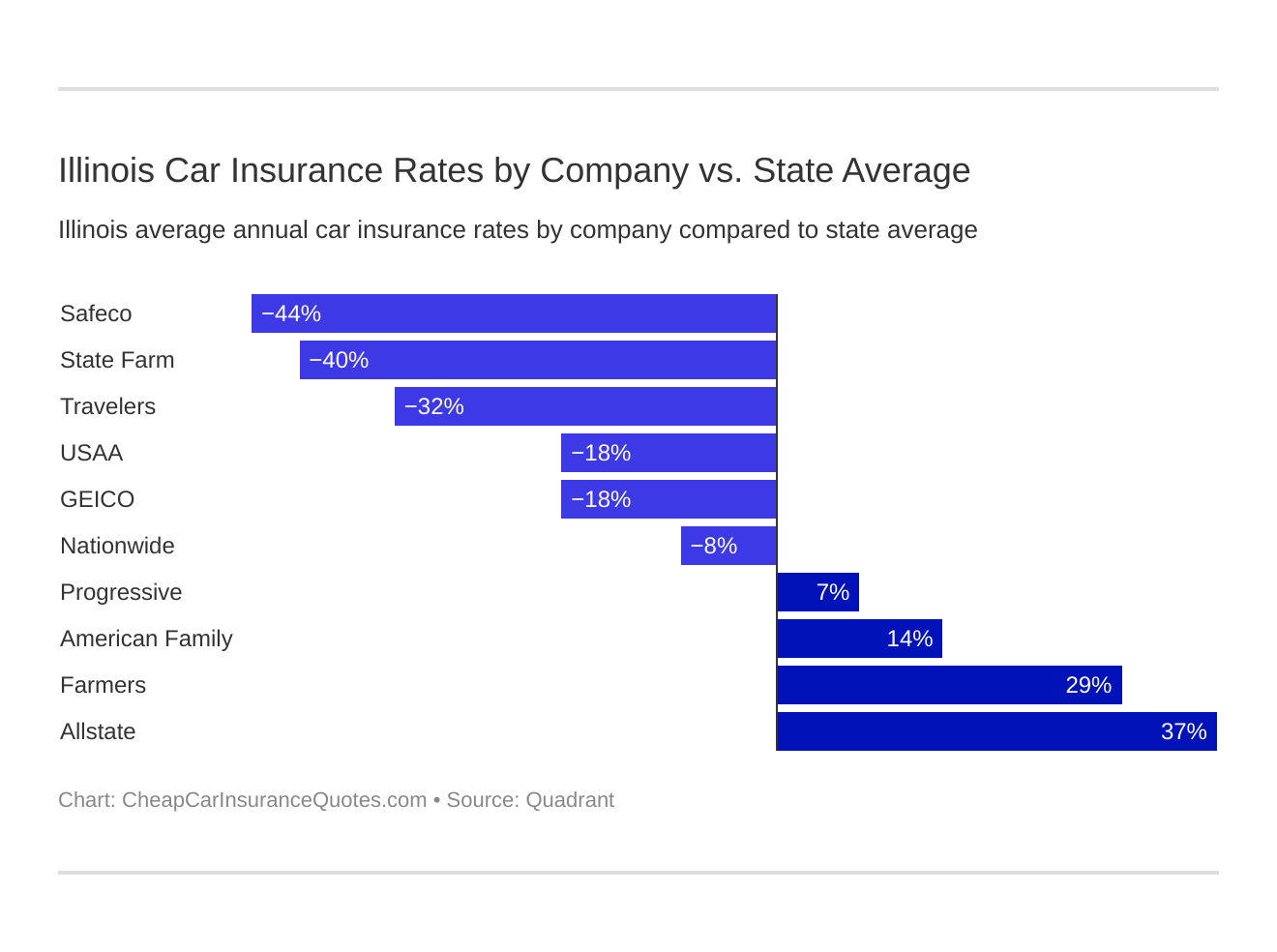

Now let’s see who is the cheapest car insurance company in Illinois.

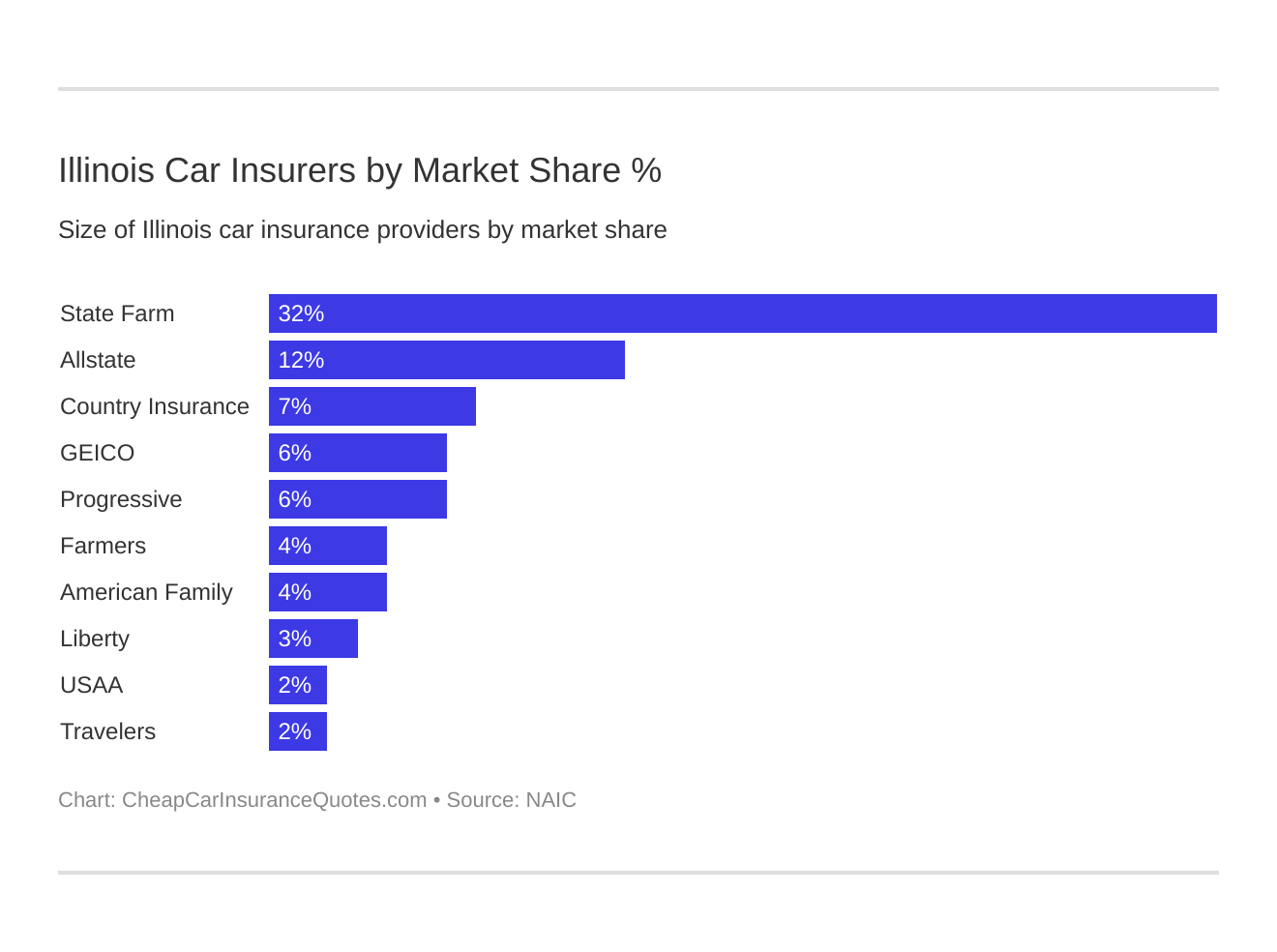

Who are the largest car insurance companies in Illinois?

Navigate Your Choices: Car Insurance Cost in Illinois by City

Compare car insurance rates in Illinois cities including Alexis, Brookport, Glen Ellyn, Marengo, and Mounds. Start now to find the best rates for your location!

| Car Insurance Cost in Illinois by City |

|---|

| Alexis, IL |

| Brookport, IL |

| Glen Ellyn, IL |

| Marengo, IL |

| Mounds, IL |

Before starting an auto insurance comparison search, you may want to brush up on your car insurance knowledge as even saving $20 or $$50 a month can quickly add up.

Enter your zip code below to get FREE car insurance quotes today!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.