North Carolina Car Insurance

North Carolina car insurance laws require all vehicles registered in North Carolina to carry liability insurance. Driving with no auto insurance in North Carolina is illegal and may subject a person to heavy fines, driver’s license suspension, personal liability for any car accident damages, and more. On average, North Carolina car insurance rates are $72/mo, or $865/yr. This is nearly forty percent below the national average. Compare rates now with our free quote calculator below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

UPDATED: Mar 1, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Mar 1, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The reality is that most drivers have no idea how much or what they are covered until the time comes when they need to file a claim

- The North Carolina Department of Transportation is responsible for administering car insurance requirements

- Many states have minimum liability insurance limits under $25,000

North Carolina car insurance laws require all vehicles registered in North Carolina to carry liability insurance.

Minimum auto insurance liability requirements are well above average in North Carolina requiring drivers to obtain levels of liability insurance sufficient for most minor car accidents.

Driving with no car insurance in North Carolina is illegal and may subject a person too heavy fines, drivers license suspension, personal liability for any car accident damages and more.

Enter your zip code above to get FREE car insurance quotes today!

North Carolina Car Insurance Requirements

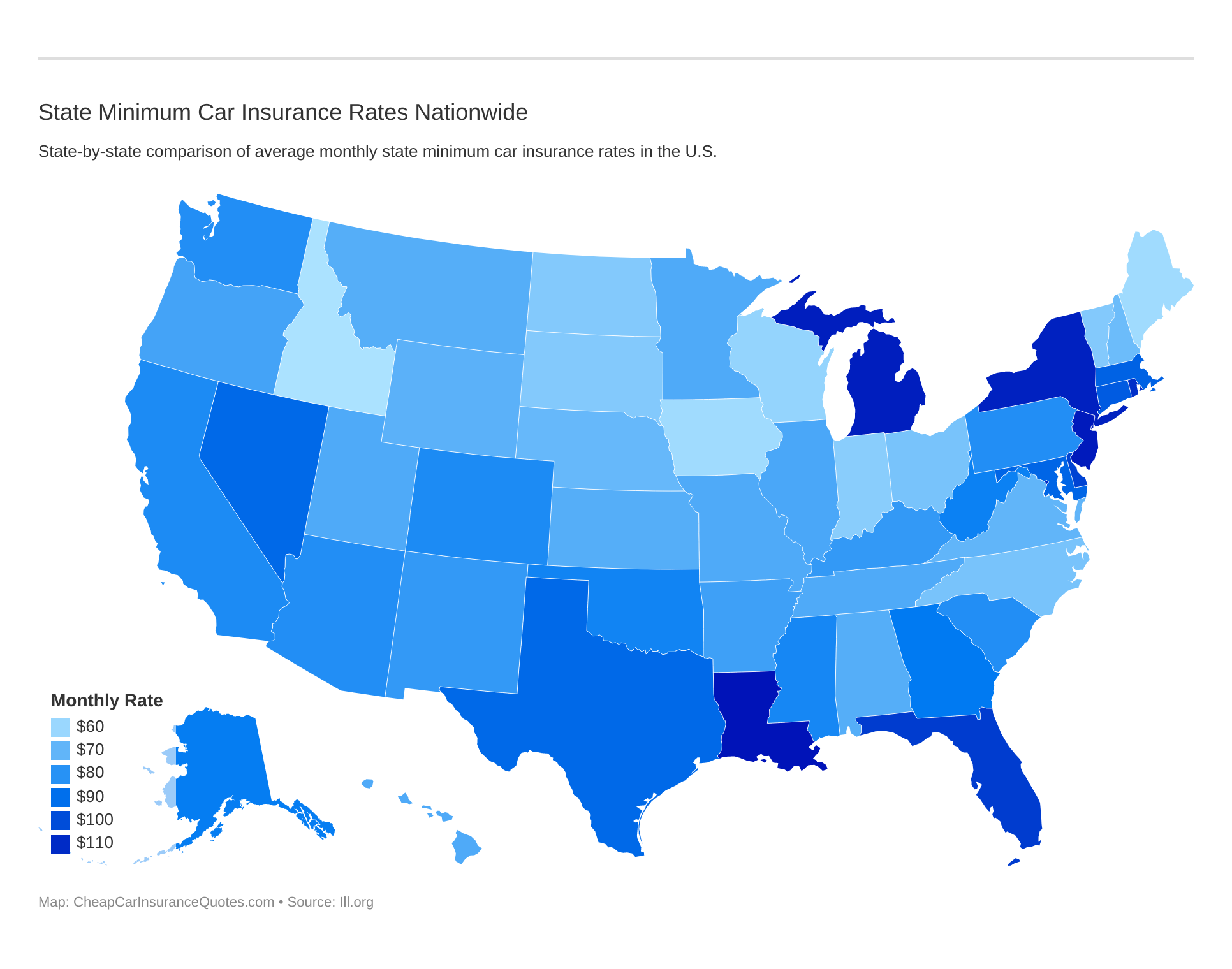

Take a look at how state minimum car insurance rates vary from state to state.

The North Carolina Department of Transportation is responsible for administering car insurance requirements and currently require all vehicles to carry at least the minimum policy limits of liability coverage.

The minimum policy limits are:

- North Carolina

- Cheap Quotes for Peachland, NC Car Insurance (2024)

- Cheap Quotes for Kannapolis, NC Car Insurance (2024)

- Cheap Quotes for Indian Trail, NC Car Insurance (2024)

- Cheap Quotes for Holden Beach, NC Car Insurance (2024)

- Cheap Quotes for Garner, NC Car Insurance (2024)

- Cheap Quotes for Erwin, NC Car Insurance (2024)

- Cheap Quotes for Burnsville, NC Car Insurance (2024)

- Cheap Quotes for Banner Elk, NC Car Insurance (2024)

- Cheap Quotes for Andrews, NC Car Insurance (2024)

- $30,000 liability insurance per person

- $60,000 liability insurance for all persons

- $25,000 property damage liability coverage

While North Carolina’s car insurance laws are higher and sufficient for most car accidents remember that liability insurance only covers injuries to other people.

Most North Carolina drivers opt for higher limits to account for the potential medical costs of car accident injuries as well as comprehensive and collision coverage.

While NC car insurance laws are pretty reasonable, drivers should always consider an auto insurance policy which provides all the coverage they need and not just enough insurance to comply with the law.

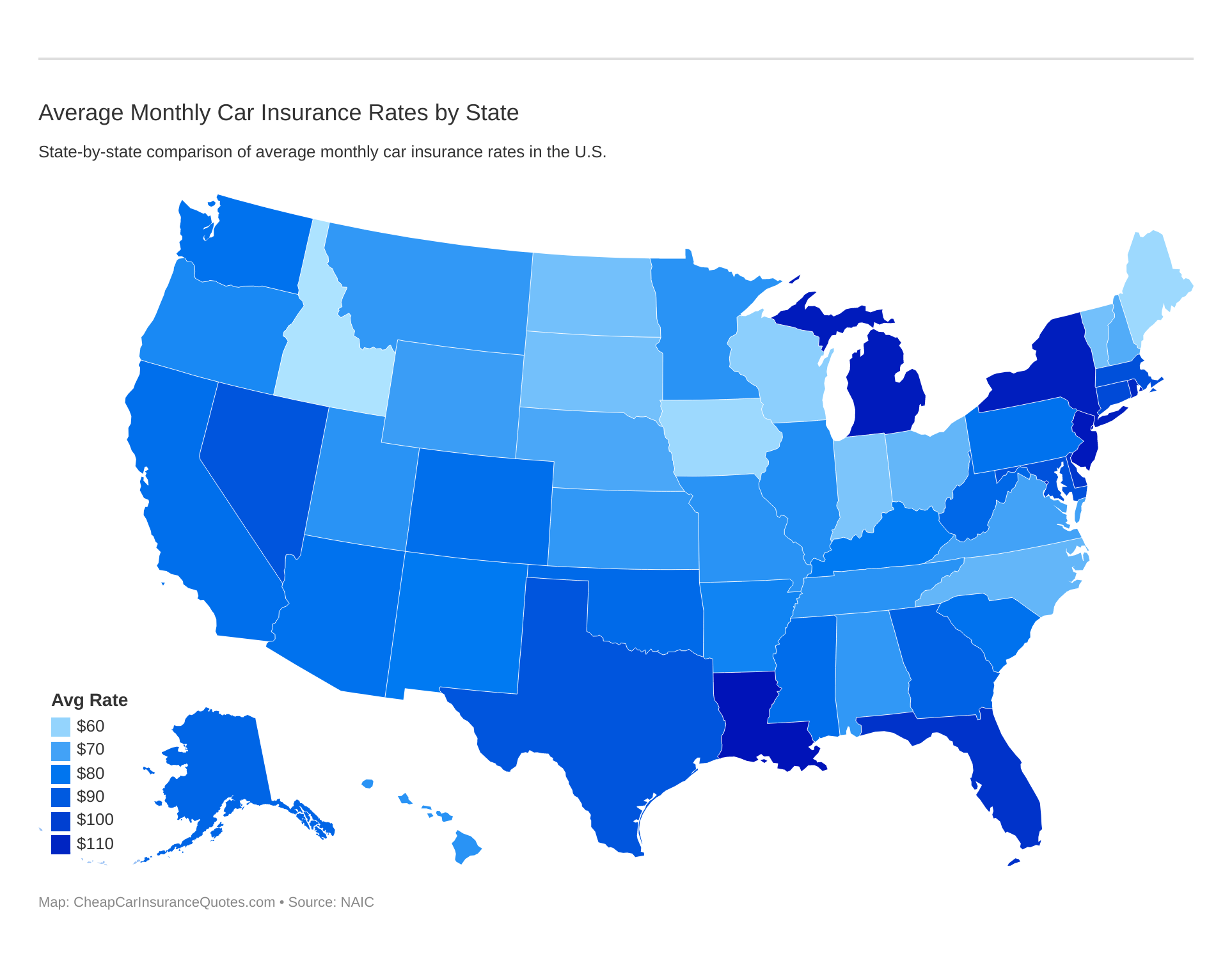

Let’s take a look at the average monthly car insurance rates.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

North Carolina Car Insurance Companies

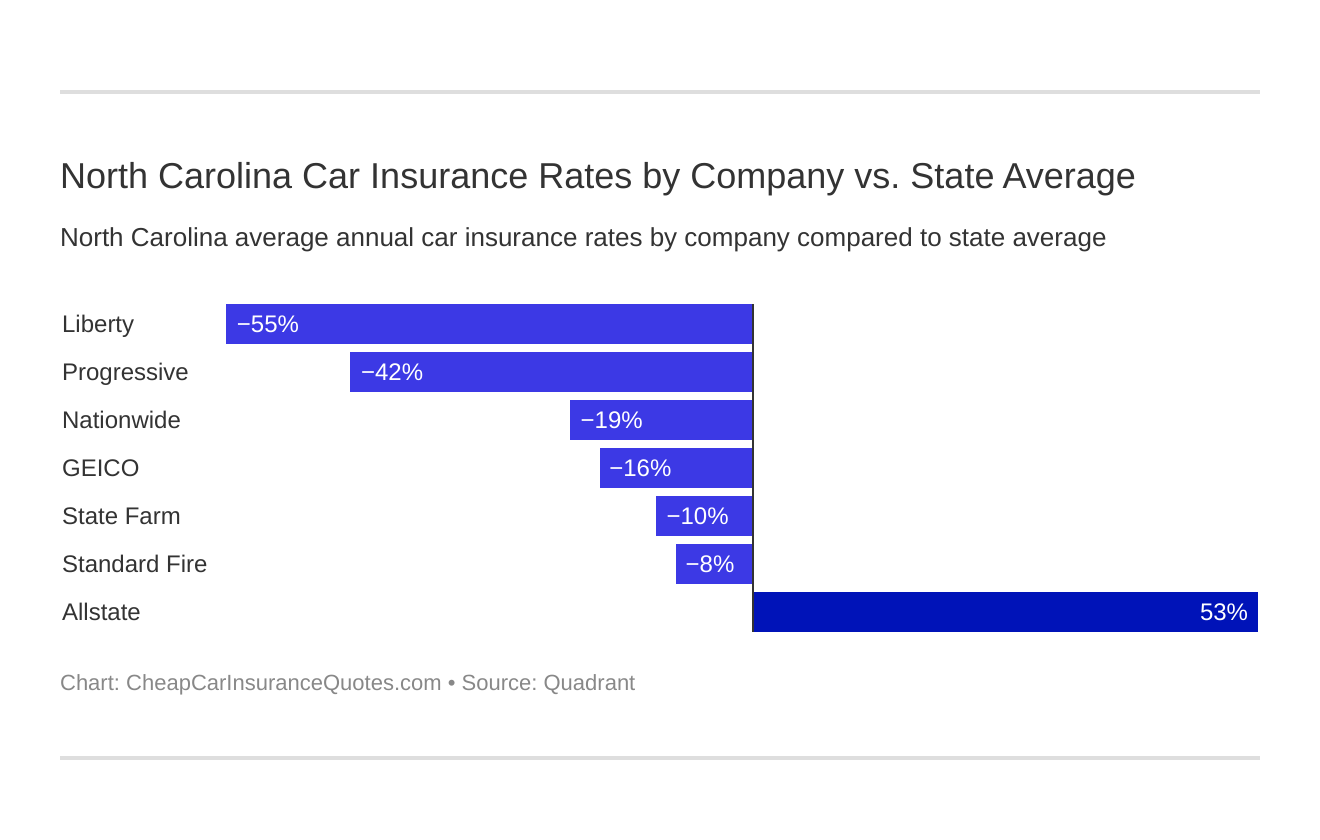

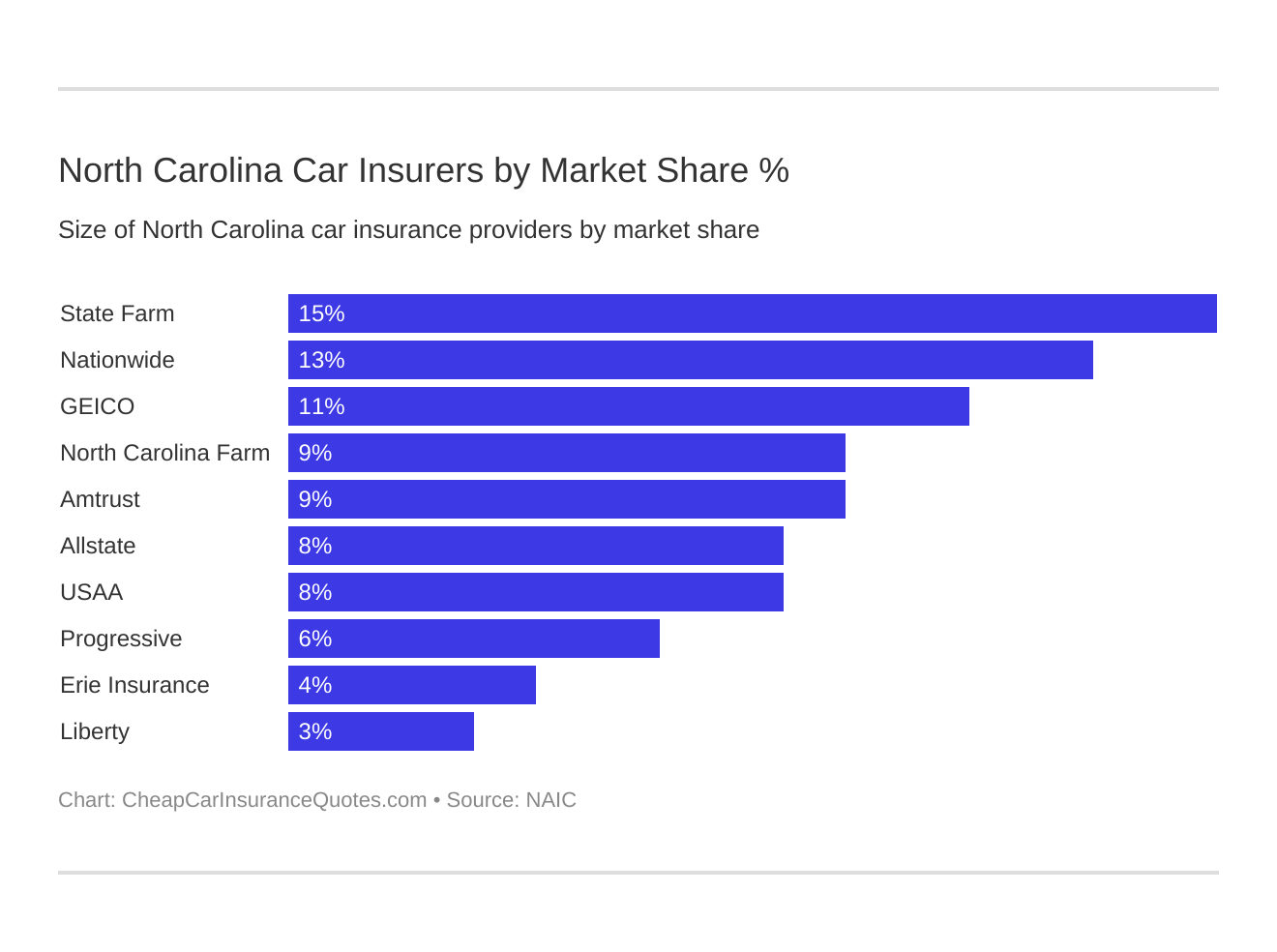

North Carolina has around 110 licensed car insurance companies including most all national auto insurers such as Allstate, State Farm, and Geico but many regional insurers also provide both affordable and reliable coverage.

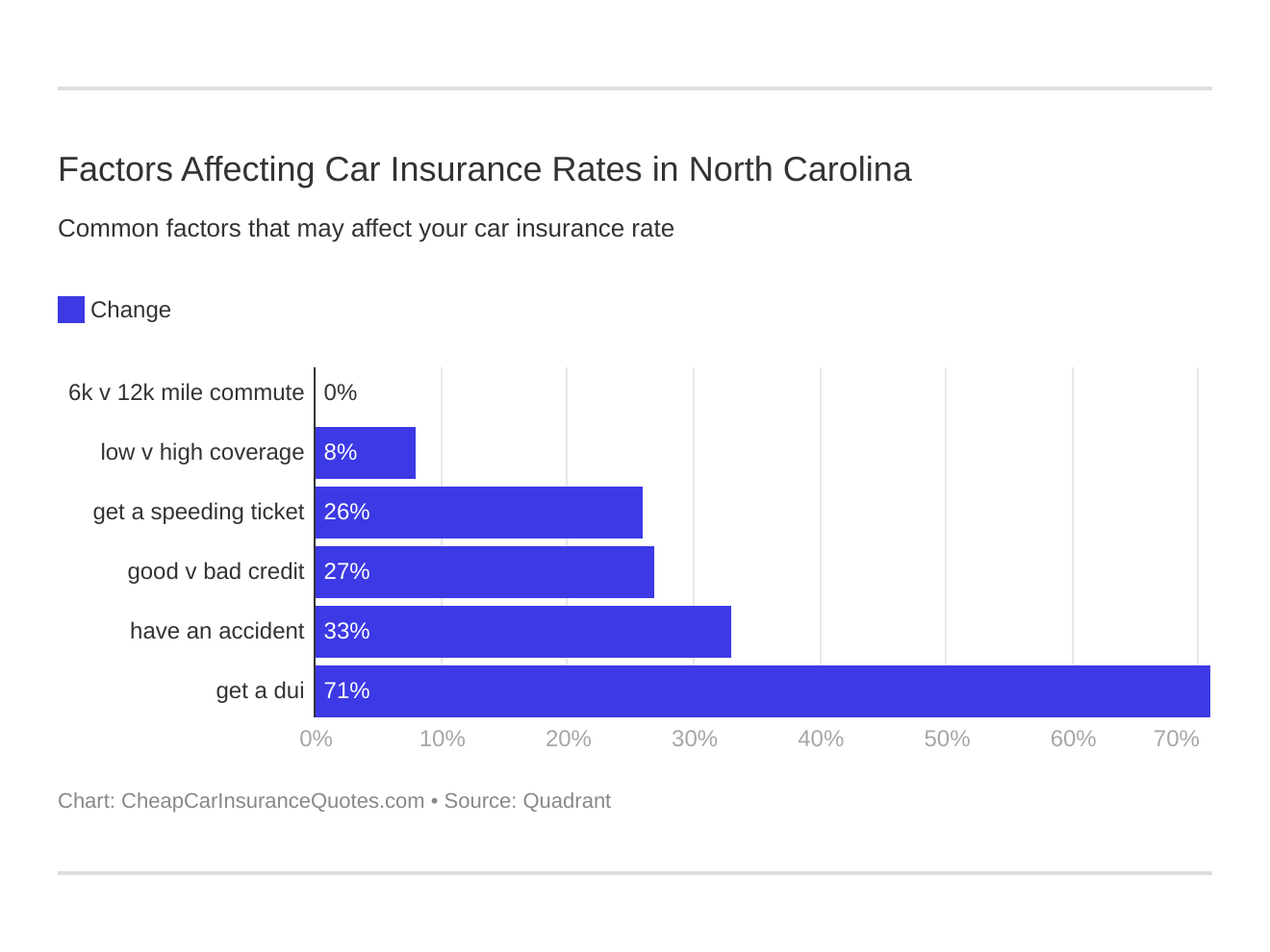

Even high-risk drivers convicted of a DUI charge or those with poor driving records and bad credit scores still have many choices.

However, it’s important to know enough about auto insurance before comparing quotes to find the best North Carolina car insurance company for you.

What do I need to know?

Some of the topics you should learn about before starting an auto insurance comparison search include:

- What kind of insurance discounts are available?

- How do policy deductibles work?

- What types of auto insurance are available?

- How much auto insurance do you need for a leased car?

- Vehicle Safety Ratings

Read more: How much is car insurance for a leased car?

Car insurance is almost never optional for typical private passenger cars, and it’s also one of the most important financial tools you can have.

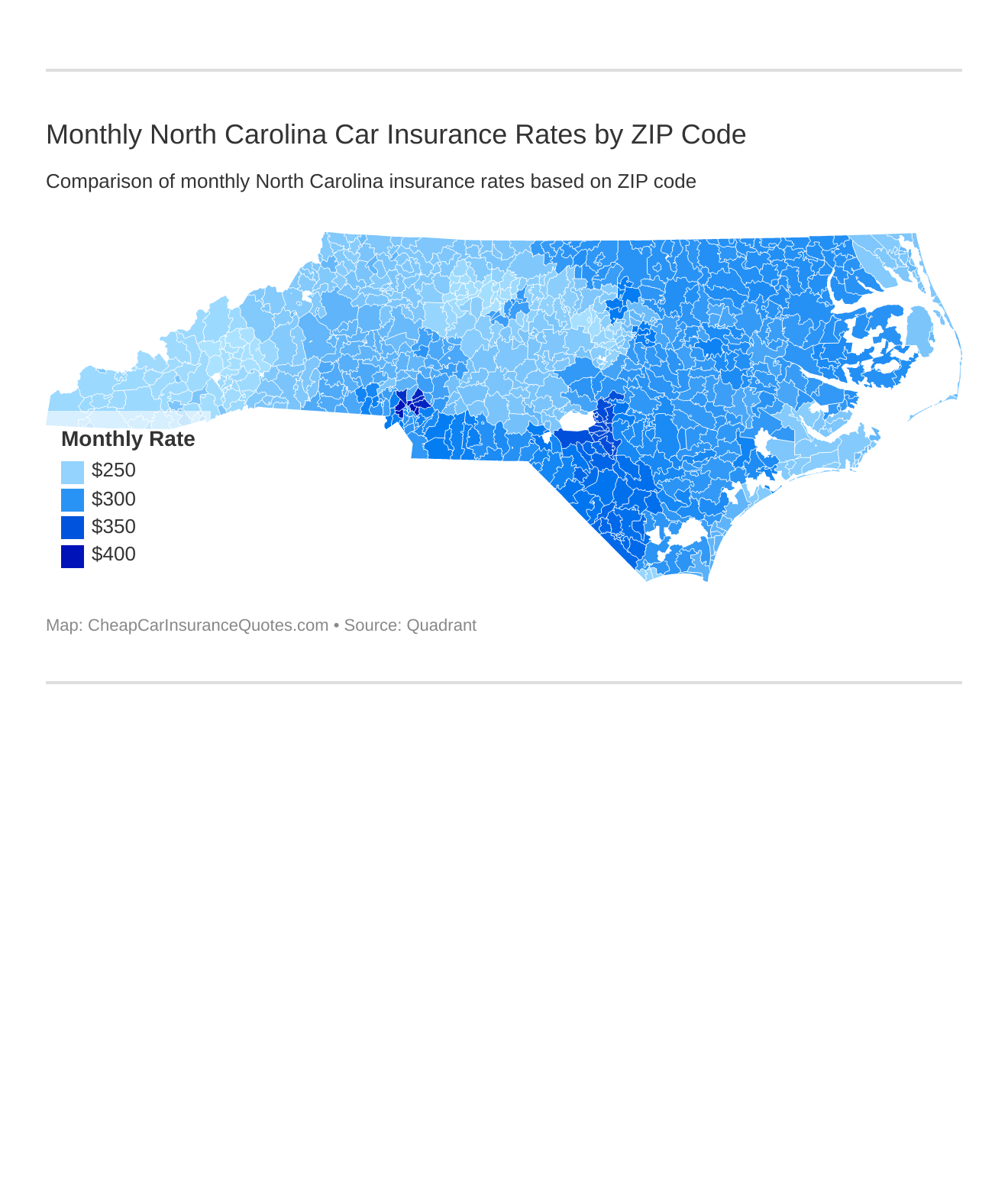

Let’s take a closer look at how ZIP codes affect car insurance in North Carolina.

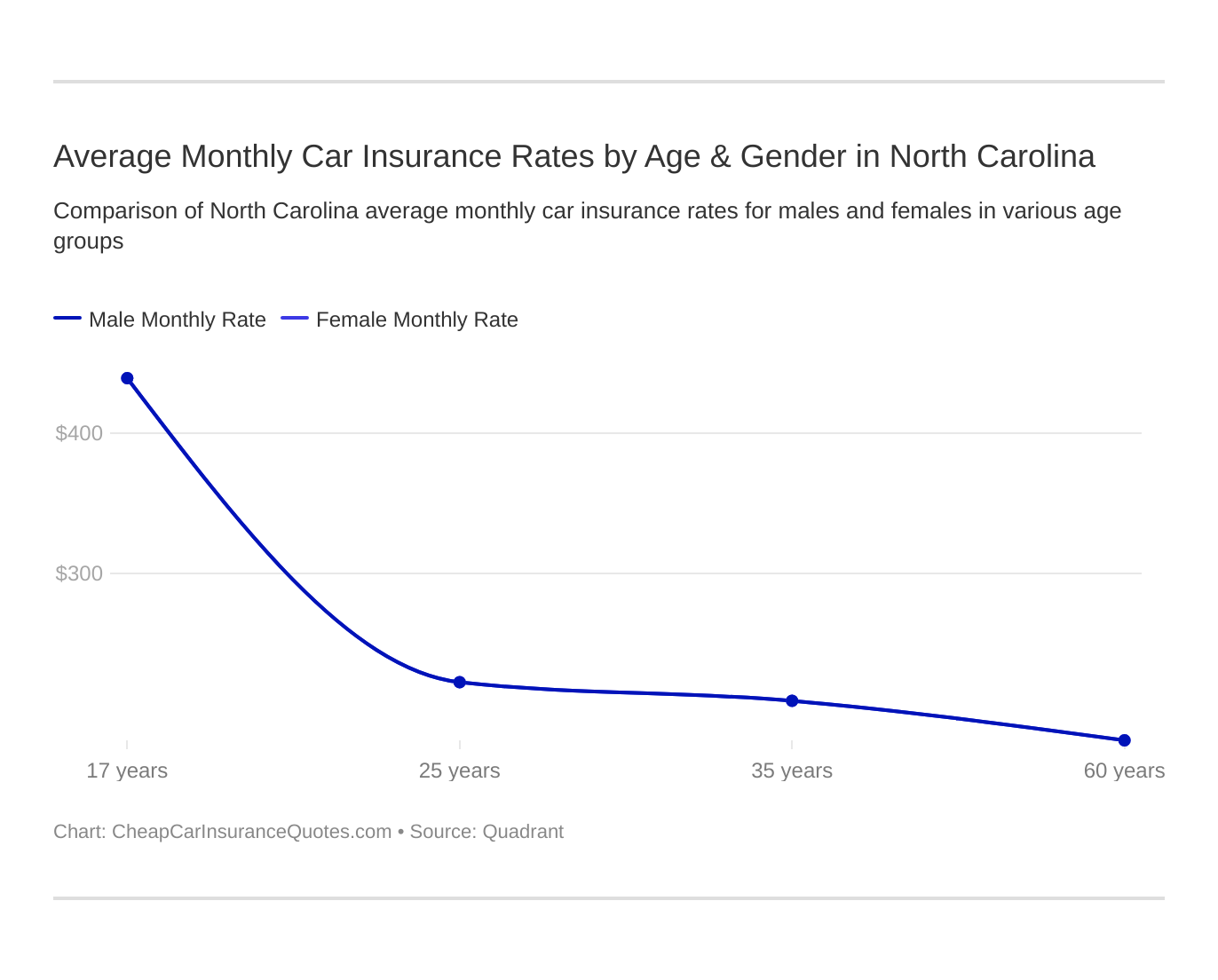

Some states have banned discrimination based on gender for car insurance rates, and this is one of those few states. As you can see the rate for males and females is the same, but the rate still varies with age.

Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

Now let’s see who is the cheapest car insurance company in North Carolina.

Who are the largest car insurance companies in North Carolina?

Learning about auto insurance before comparing car insurance quotes can save you both time and money to take a few moments and brush up on your car insurance 101 knowledge today.

Discover Car Insurance Costs Across North Carolina by City

Explore the diverse range of car insurance rates across different cities in North Carolina. From Andrews to Garner and Banner Elk to Kannapolis, delve into the comparative costs of car insurance in these locations. Whether you’re a resident seeking the best rates or simply intrigued by regional differences, start comparing rates now to find the most suitable option for you.

| Car Insurance Cost in North Carolina by City | |

|---|---|

| Andrews, NC | Holden Beach, NC |

| Banner Elk, NC | Indian Trail, NC |

| Burnsville, NC | Kannapolis, NC |

| Erwin, NC | Peachland, NC |

| Garner, NC |

Enter your zip code below to get FREE car insurance quotes today!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.